Avoiding Liens

DEAR TIM: I am building a new home soon. Even though I have the ability to pay for the house myself, I was wondering if it would be a better idea to obtain a loan. Will the bank make sure all of the workers and suppliers get paid so that no liens are filed against my new home? What can the average person do to make sure that every person who works on a project gets paid? Paul W., Woonsocket, RI

DEAR PAUL: A strong economy, impressive gains in the stock market, robust equity in existing homes, and large inheritances allow some people to build new homes without having to borrow funds. I have built several houses for people who were able to open their checkbooks to pay all of the bills. Avoiding legal problems caused by unpaid workers and suppliers is not too difficult, but it does require attention to detail and actually starts during the bid process of the job.

Most lending institutions will not offer you the protection you are looking for. A bank, credit union, or savings and loan simply wants to make sure that the value of the land and the house are equal to or greater than any funds they have paid to others on your behalf. It is possible for a worker or a supplier to file a valid claim against a property even if you have a new home construction loan and the bank's appraiser checks the construction progress before each payment is made.

Protection against liens and other claims starts at the beginning of the job. You should obtain a detailed cost breakdown of the job showing the many different tasks, the cost associated with each of these items, and the name of the sub-contractor or supplier who is providing the goods and the services.

This cost breakdown not only helps you to compare bids from different contractors, but it also becomes the benchmark against which payments are made. For example, if the cost breakdown sheet indicates that the foundation and footing costs $12,500, then the check written to that sub- contractor should not exceed this amount unless authorized written changes were approved by you. In other words, you need to set up a system of checks and balances to make sure that you only pay what you should and that the amount is correct.

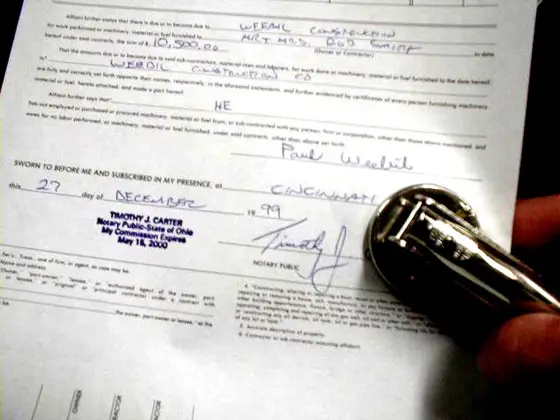

Before checks are issued by a lending institution, they almost always require builders, sub- contractors, and suppliers to supply a notarized affidavit, waiver of lien, or release of lien form. These documents are simply legal receipts signed by a company official that give the legal address of the property where the work was done or materials were delivered, the dates that the work was performed or material was delivered, and the amount of money owed for that time period. If the document is executed properly and the notary verifies that the person who signs the document is indeed the company official, then this receipt gives you lots of protection against future claims against the property.

If you live in a larger city or town you can have an affidavit company produce and process the forms for you. These professional services do all of the paperwork and most of them have the highest degree of integrity. They will prepare the affidavits and submit them to you for payment. It is still your responsibility to make sure that the right amount of money is going to the right person. Once you feel all is in order, you write the check to the person or company named on the affidavit.

You also need to perform due diligence. As hard as it may seem, you should visit your job site each day and introduce yourself to the workers. Be cordial and ask them who they are, who they work for. And what they are doing. Write this information down in a journal. When it is time to pay for this aspect of the work, make sure that you see affidavits that have this company name on them. If not, you may be subject to a valid claim of non-payment.

If you decide not to take out a loan, consider making arrangements to issue checks directly to each sub-contractor and material supplier. This gives you a high degree of control as you then know the individual is getting the money. You can also arrange to issue checks that name the builder and the sub-contractor or material supplier. These checks require the signatures of both parties in order to be cashed or deposited. Finally, no one, and I mean no one, gets a check unless they give you an affidavit first!

Column 300