Save for a Rainy Day

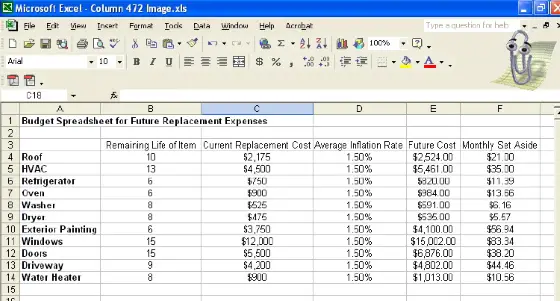

Save for a Rainy Day Accounts | An electronic spreadsheet can help you determine how much money you need to set aside each month for periodic repairs. Image credit: Tim Carter

DEAR TIM: I realize that interest rates are at or near historic lows, but my home improvement emergencies and needs don't always happen at once. It seems I always fret about how to pay for the next thing that breaks or needs updating. Is there a way to create a realistic budget for home repairs and emergencies? If so, how do you account for things that seem to have a medium to long useful life? Maria B., Cincinnati, OH

DEAR MARIA: Owning a home is indeed wonderful, but the maintenance baggage that comes with home ownership can cause financial hardships on a frequent basis if you don't put away money on a regular basis. To make matters worse, if an expensive repair becomes necessary when funds are limited, the low bidder may actually cost you more money down the road when his work falls apart prematurely or he causes damage to parts of your home that previously were in fine shape. Home maintenance financial issues can be challenging and complicated to say the least.

It is extremely interesting how many people who buy new homes think they have nothing to worry about for a very long time. Anyone who has bought a new condominium knows differently.Those who took out a loan for their condos not only have to pay a monthly mortgage payment but they also have to pay a monthly condominium assessment fee. Part of that fee covers current expenses of garbage removal, hallway cleanup, security, grass cutting, etc., but a significant portion of the fee is actually salted away in an interest-bearing savings account to pay for common space repairs that may be one, five or even 15 years down the road.

What is a sinking fund?

Everyone who owns a home, no matter if it is new or 100 years old, needs to create a special savings account to cover the cost of future home repairs. Accountants often call this a sinking fund because you need to make regular payments into a fund whose proceeds will pay off a future expense or expenses. The trouble is, many people do not set aside enough money each month and they do not raise the monthly payment each year to account for inflation.

If you want to see the full size image of the Spreadsheet page I created showing an example of different items in a typical house, the remaining useful life at that point in time for each item, and how much money you need to put away each month to be prepared for the anticipated cost, then Click Here now.

If you want to make your own calculations, open the Save For A Rainy Day Google spreadsheet. Enter your information and see how much you will have to save for that rainy day. A Google account is required to view the spreadsheet. Signing up is free. If you aren't currently signed into your Google account, the above link will take you to the sign in or sign up page.

How do you get starting saving for the rainy day?

If you live in an existing home, the best way to get started is to complete an appraisal of all of the major systems in your home. Inspect your roof, heating and cooling equipment, appliances, exterior surfaces, windows, doors, exterior paving, plumbing, and possibly your electrical equipment. Determine the condition of all of these and more importantly the remaining useful life in each category. Fortunately, some things in the above list have longer useful lives than others. If they all had the same useful lives and were installed at the same time, they might all go bad at the same time. This could become a financial time bomb.

Where do you get quotes on replacements?

Try to get quotes as to the current cost to replace each item on the list. Friends and neighbors who have had similar work done may be able to help you with pricing. Do not rely on a price that is 18 months old or older. If you can get free estimates from contractors that advertise this service, do so. Be sure to always ask how long the repaired or new item will last. This information will be needed to keep your sinking fund calculations accurate as time passes.

To determine how much money you need to set aside now for future repairs start with just one item on the list. For example, let's say you determine your roof has only ten more years of useful life. If your roof is 15 squares in size and the current roof you prefer costs $145.00 per square for total replacement, then it would cost $2,175.00 in today's money to have a new roof installed.

Assuming a 1.5 percent inflation rate per year over the next yen years, you will need $2,524.00 to pay for the roof replacement. Since there are 120 months between now and when the roofer pulls away from your house, you should begin to set aside about $21.00 per month. This computation does not cover the interest that will accrue as that money sits in the savings account. Use that extra money to cover any cost overruns or estimating mistakes.

CLICK or TAP HERE to get FREE quotes from local General Contractors.

Using a spreadsheet to calculate your monthly deposit

To get the total number you need to deposit each month into your new sinking fund, you must run the calculation for each item on your list. This total number will possibly surprise you. If saving money is not an option because your budget is already too tight, you will have to make these payments in another fashion. My guess is that you will bundle the repairs into one lump sum and then apply for a home equity loan. One thing is for sure, you will pay the money in one form or another. I suggest you set aside money now by cutting back or eliminating some other extravagance in your lifestyle.