Loan Prepayment Benefits

Loan Prepayment Benefits - You Can Save Thousands of Dollars

My youngest daughter moved out West thousands of miles away from me in 2022. Once in her new city, she had to purchase her first car. She bought a used car from Carvana.

At the time of the purchase, she had a job prospect but was not employed. She had an excellent credit score very close to 800 and a hefty rainy-day fund. Within a month of purchasing the car, she obtained a very high-paying job as a private flight attendant for a multi-billionaire. Making her car-loan payments as well as her apartment rent was not an issue.

Her lack of a job at the time of buying the car caused her to get raked over the coals with a 10 percent rate. The term of the loan was six years.

Big Christmas Bonus

My daughter informed me that she was given a sizeable Christmas bonus from her employer. She wanted to take part of the bonus, $5,000.00, and invest it. She had gone to a local bank and discovered she could get a one-year certificate of deposit for 3.5%. She also knew she could send the money to the professional investment firm that handled her rainy-day fund.

I told her that the best thing to do would be to apply the $5,000 to pay down her car loan. I decided to poll my newsletter list because I knew that any number of my subscribers were financial experts. As you might suspect, I was flooded with a plethora of excellent advice. I decided to share it with you.

Let's get started.

"Does She Have a Rainy-Day Fund?"

A vast majority of the responses that poured in wanted to make sure she had a rainy-day fund that would cover all of her living expenses for a minimum of six months. I had NOT SHARED with my newsletter list that she had one of these funds.

This was, perhaps, the best piece of advice offered up by my newsletter subscribers. If you don't have a rainy-day fund, you should. My next-door neighbor who is a retired CPA is far more conservative. He feels you should have five years' worth of living expenses saved up. Very few people can achieve this goal, although it's a very noble goal to aim for.

The bottom line is you SHOULD HAVE a rainy-day fund.

Prepayment Penalty?

One of the things I told my daughter before polling my newsletter experts was, "Be sure you read the loan agreement. Discover if there is some hidden prepayment penalty. If there is, the penalty may negate all the benefits of paying off part of the principal early."

That same advice was offered up by quite a few of my subscribers. When you are negotiating for a loan, be SURE THERE IS NO PREPAYMENT PENALTY. Make the loan officer show you in the loan agreement the language that says you can PREPAY the loan early with NO PENALTY.

Get a NEW Loan ASAP!

You may have been one of my subscribers that suggested my daughter re-negotiate her loan ASAP. With ten months of on-time loan payments PLUS a great job, she'd be able to get a much more favorable interest rate. She can apply the $5,000 to the new loan principal right away to get lower monthly payments. Then she can do an extra trick you'll see below to pay off the new loan in HALF THE TIME.

Guaranteed 13 to 15% Interest?

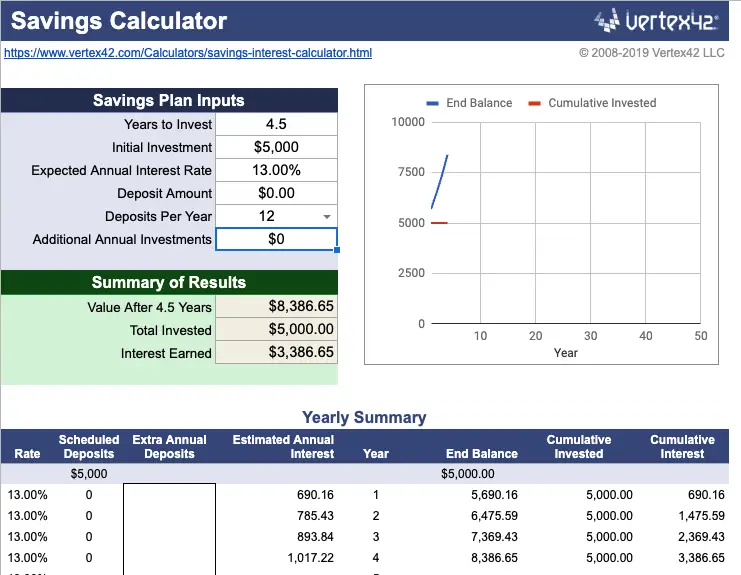

Several financial experts pointed out that if you wanted to get a HIGHER return on investment rather than apply the $5,000 to prepay down the loan, you need to find some investment that GUARANTEES you an annual interest rate of better than 13%. By paying down the loan you effectively are getting a 10%, roughly, return on your investment for the $5,000. You'll see this detail shortly. Hang in there.

The reason you'd need to get at least 13% is that you have to pay Federal taxes on interest income. You may even get DOUBLE TAXED on this as your state may have a tax on interest income.

I used a fantastic savings calculator that shows what happens if you invest $5,000 for 4.5 years at 13% interest rate. You use 4.5 years because that's the amount of time left to pay down the loan should you make a one-time payment of $5,000.00 on the principal. You'd get $3,386.65 in interest at 13% for 4.5 years. But remember, you need to pay taxes on that income.

Calculating Interest Savings

When I reached out to my newsletter subscribers, I shared that I thought the projected savings in interest on my daughter's car loan by making a one-time $5,000 principal payment would be $6,430.83. I used an inferior online template that didn't calculate the savings the correct way.

I was WRONG. I wasn't even close. Not only that, I didn't use critical-thinking skills - SHAME ON ME - to think about what the total interest might be. You'll see that just below. I also goofed up by thinking that the $5,000.00 would be a savings when in fact it's just re-paying principal owed.

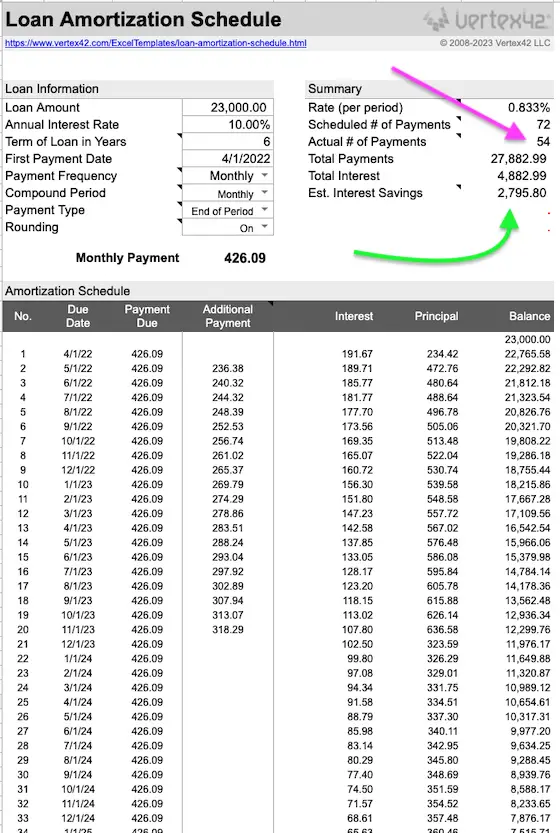

Ken, one of my subscribers, sent me this fabulous page where you can download and use all sorts of loan calculators. I used the first one at the top - Loan Amortization - to calculate the TRUE interest savings.

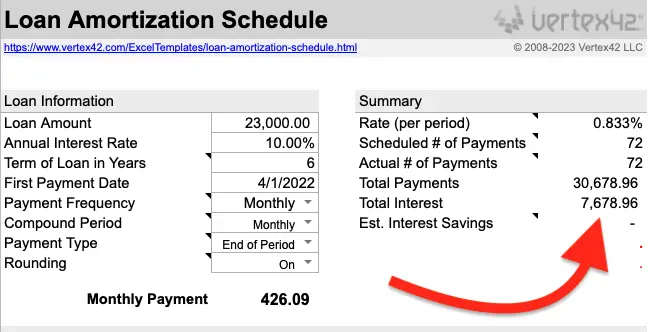

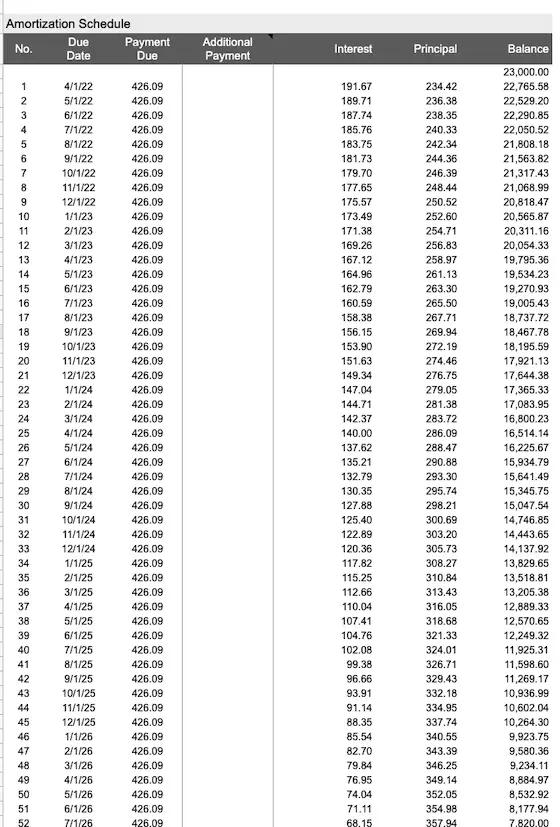

Using the template suggested by Ken and NOT making an extra principal payment you can see rapidly what the total interest would be on my daughter's car loan. Look:

The table above shows the original car loan of $23,000 for six years at the 10% interest. If you make the 72 payments of $426.09, you'll end up paying $7,678.96 in interest over the life of the loan.

You can see that my original calculation was so far off as to be laughable.

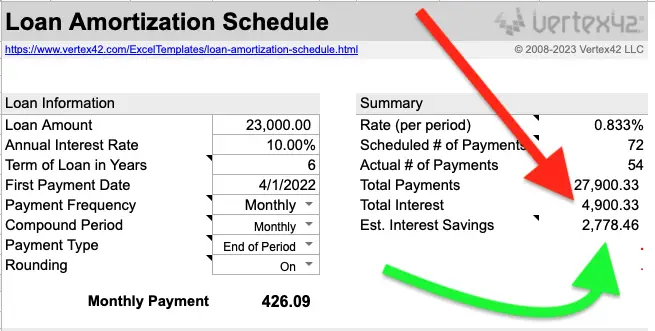

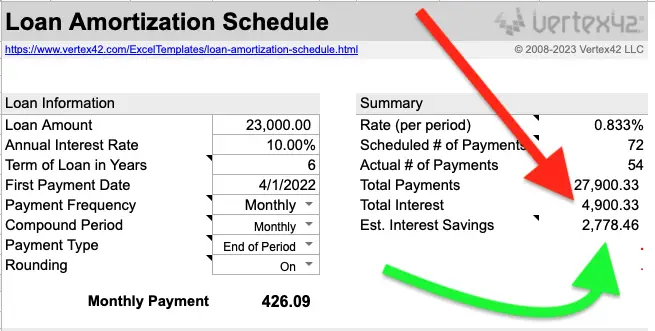

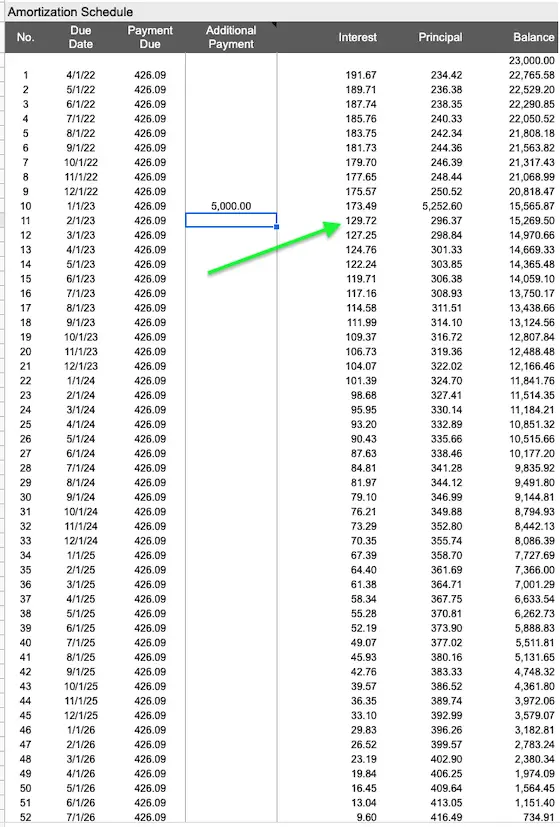

Look what happens if you make a one-time $5,000 principal payment ten months into the life of the loan.

One simple payment of the $5,000 after just ten months into the loan saves almost $3,000.00 in interest! The actual amount is $2,778.46 in interest. What's more, the loan is paid off in 54 months, not 72 months. Look at these two giant tables to see how that one payment of $5,000 CHANGES the amount of interest and principal in the subsequent payments starting in month 11. I'm sorry but I could only grab a screenshot of 52 months on my monitor.

This table above shows NO extra principal payment. Look at the principal and interest payment on payment #11.

Look at how the interest payment in month 11 is DRASTICALLY LOWER than the previous month. This is because the interest is calculated EACH MONTH ON THE UNPAID PRINCIPAL. Since the principal dropped by $5,000, the interest MUST BE LOWER.

But It Gets BETTER

A few days after polling my subscribers, Rob reached out to me. He had stellar advice. It's important to realize a few others offered up similar advice, but didn't outline exactly what they had done to achieve paying off their loans early.

Rob noted up front that his suggestion deviated from my proposed one-time principal payment of $5,000.00. His method is more complex and it becomes a multi-variable calculation because you only use part of the $5,000 each month and whatever is NOT used to pay down the loan is invested. The issue is what kind of interest can you get that PROTECTS the remaining $5,000.00 so it's not at risk as might happen should you invest in stocks or some other risk-based investment?

Rob's method is simple. You create an amortization table as you see above - I'm talking about the table just above that does NOT have the green arrow in it. You can see the interest and principal you'd be paying each month with your regular payments of $426.09. This is very powerful with long-term loans such as a 15 or 30-year home mortgage. With my daughter's car loan, it's different.

Rod said, "Look at the table your loan officer will give you. When it's time to make payment #1, look at how much principal would be paid in your SECOND payment. Add that to your first payment and repeat this each month." In the case above you'd be paying the scheduled $426.09 PLUS $236.38 for a total payment of $662.47.

What you see below is Rob's method but I STOPPED when I exhausted the $5,000.00 at payment #20. But remember, over those 20 months you would be earning some interest on the money you had not paid out yet. It's very interesting to note that the amount of interest saved is nearly identical to what you'd save had you made the lump-sum $5,000 principal payment in month ten of the loan.

Doing it Rob's way the loan is paid off in 54 months if you make NO OTHER principal payments. But if you continue to add more principal with each payment you might pay off the loan in as little as 36 months.

The Bottom Line

I think it's obvious that you can save vast amounts of interest if you prepay off a loan. In my daughter's case, should she make a lump-sum payment this month she'll save almost $3,000.00.

You tell me what SAFE investment opportunity offers you a GUARANTEED payment of $2,778.46 over 4.5 years if you invest $5,000.00. I know I can't think of one!

One Response to Loan Prepayment Benefits